how to file taxes for coinbase

Choose a Custom Time Range select CSV and click. Connecting your Coinbase account to CoinTracker.

Want Your Tax Refund In Crypto Turbotax And Coinbase Have You Covered Https Www Wsj Com Articles Want Your Tax Refund In In 2022 Tax Refund Turbotax Bitcoin Price

This will redirect you to Coinbase to grant CoinTracker read-only access to your account.

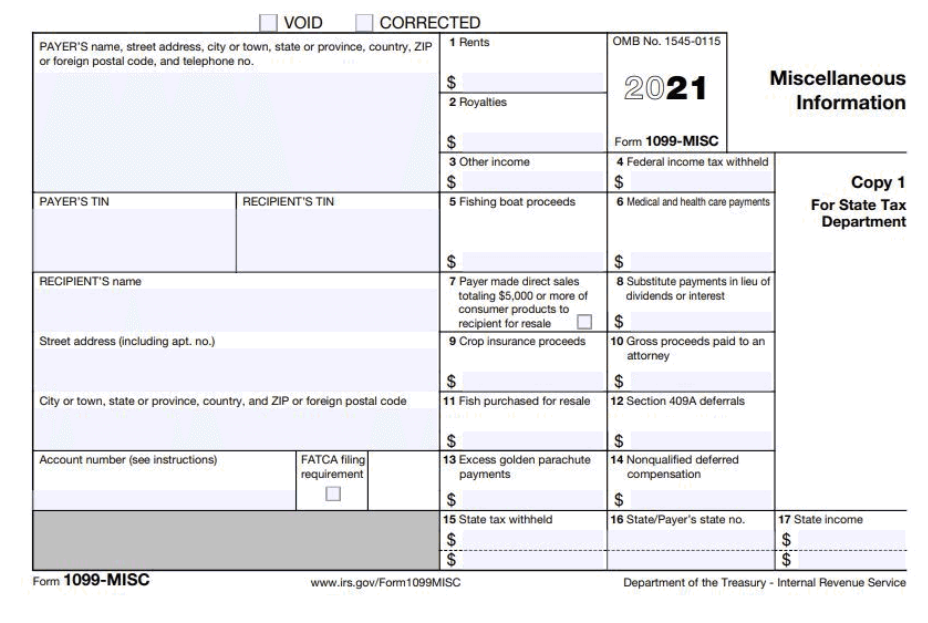

. What a 1099 from Coinbase looks like. Login using your TurboTax credentials and complete your tax return plus Coinbase. If you purchased the.

This is where you report income from sources other than wages interest and dividends. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct. Keep in mind that the IRS and Coinbase are currently in a disagreement about whether or not Coinbase needs to turn over all major data about its users.

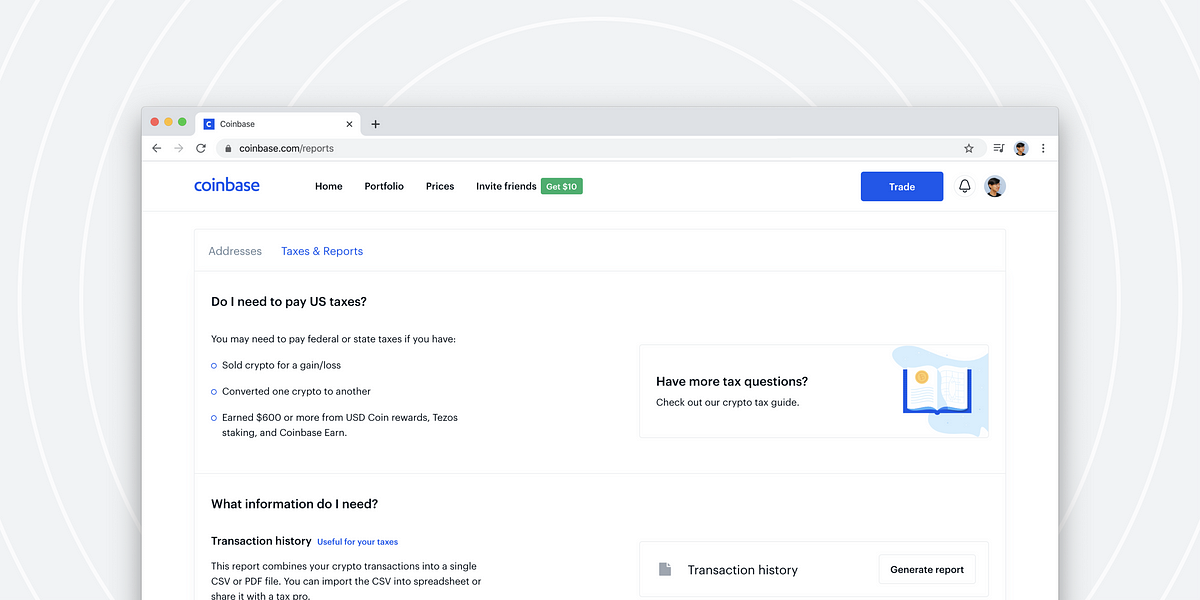

Click Continue with Coinbase. There should be a button for exporting your entire wallet history in Coinbase Wallet as a CSV file. If you are a non-US Coinbase customer you will not be sent any tax forms by Coinbase but you can still generate reports on the platform and then use these for.

If you use Coinbase you can sign in and download your gainloss report using Coinbase Taxes for your records or upload it right into TurboTax whenever youre ready to file. Treat them as capital gains. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide.

Coinbase wants to help customers file cryptocurrency taxes for the 2021 tax year. Log in to Coinbase Pro click on My Orders and select Wallets. In order to receive Form 1099 you have to be an account-holder on Coinbase in the US or US tax-compliant areas.

The gain from selling off Bitcoins is capital gain absent some rather unique facts and whether it is long or short term depends on the holding period. Httpswwwcointrackerioacryptodad OPEN. If you are subject to US taxes and have earned more than 600 on your Coinbase account during the last tax year Coinbase will send you the IRS Form 1099-MISC.

Does Coinbase report the IRS. Begin filing your taxes from the Coinbase section of the TurboTax website. Place it in other income if the software ask if this was earned income the answer is no.

If you buy a 250 coffee with it and its still worth 5 so you only use half. Now your basis is 5 if it is traded at 7 you have a 2 gain if you sell at 3 you have a 2 loss. It says reporting rewards Although also Im not sure if the tax bit at the end is referring to earning 600 in income taxes though or 600 strictly from crypto rewards.

Coinbase Pro Tax Reporting You can. On January 25 2022 Topic. This is where you.

To access from the. Try Cointracker for your Cryptocurrency tax calculations Get a 10 Discount when you use my link. Its probably below their limit to send a 1099-misc or similar 1099.

This is where you calculate your total capital gain or loss that appears on Form 1040. Non-US customers wont receive any forms from. Currently Coinbase sends Forms 1099-MISC to US.

The crypto exchange company said. Answer 1 of 3. Upload a CSV file to Coinpanda.

Check out our frequently asked questions found within the Coinbase Taxes Summary section for more information. When you have this ready simply import the file into. You also have to complete transactions in cryptocurrency.

If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received.

Best 9 Upcoming Defi Tokens Are The Tokens That Will Launched Soon Top Investors Like Binance Coinbase Are Behind These Pro In 2021 Best Crypto Bitcoin Account Token

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

Koinly Free Crypto Tax Software Tax Software Filing Taxes Cryptocurrency Trading

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group

Markets Bitcoin 4k Ahead Bitcoin S Low Volume Price Pullback Could Be A Bear Trap Bit Ly Etsydeals Bit Ly Etsydeals Bear Trap Cryptocurrency Bitcoin

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Understanding Crypto Taxes Coinbase

Do You Have An Itin Individual Taxpayer Identification Number If So Be Sure To Submit Your Renewal Application Irs Taxes Irs Enterprise Content Management

Cryptocurrency Exchange Coinbase Introduces A New Tax Calculator Cryptocurrency Trading Cryptocurrency Tax

![]()

Coinbase Makes It Easier To Report Cryptocurrency Taxes The Verge

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Pricing Of Cryptocurrency Tax Software Beartax Tax Software Cryptocurrency Accounting Firms

The Complete Coinbase Tax Reporting Guide Koinly

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

Koinly Free Crypto Tax Software Tax Software Filing Taxes Cryptocurrency Trading

Wealthsimple Smart Investing In 2021 Money Management Advice Investing Investing Money

Pin By Piao On 品牌插画 Website Illustration Illustration Map

Cartesi Is Now On Coinbase Earn Earnings Cryptocurrency News Bitcoin Currency